The concept of financial leverage is used by companies and investors. Investors use it to significantly increase the profits they get from investments. They use different tools like futures and margin accounts. Companies can use leverage to finance their assets, which means they can use debt-claims instead of including capital in order to invest in business and increase the worth of shareholders.

Using forex leverage

Investors use leverage in forex to get a profit from the fluctation of two different countries exchange currencies. The attainable leverage in the forex market is one of the biggest ones that investors can attain. Leverage is activated by a loan that a broker gives to an investor and that is handled by the account of the broker or investor.

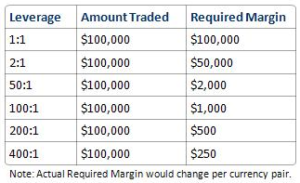

If a trader decides to trade in the forex market, they need to open an account with a broker first. Usually a leverage of 50:1, 100:1 or 200:1 is offered depending on the broker and the trading position size of the investor. What does it mean? A 50:1 leverage means that the minimal margin claim for the trader is 1/50 = 2%. With a 100:1 leverage means that the trader must have at least 1/100 = 1% from the value of the transaction available on their trading account. Usually a transaction is 100 000 currency units and the leverage for that would usually be 50:1 or 100:1. The leverage 200:1 is typically used for a position of 50 000 dollar position or less.

In order to trade 100 000 dollars with a margin of 1%, the investor only needs to have 1000 dollars on their account. With that type of transaction the leverage is 100:1. It’s a lot bigger of a leverage compared to a 2:1 that’s usually used for stocks and a 15:1 that’s usually used for futures. Even though a leverage of 100:1 might seem very risky, the risk is actually much smaller if you take into consideration the fact that currency prices change less than 1% in a day of trading. If currencies fluctuated as much as stocks, brokers would not be able to offer such a high leverage.

How can leverage backfire?

Even though there is a possibility to earn significant profit by using leverage, it can backfire against investors too. For example if a currency that is one of the bases to your investment, starts to move in an opposite direction you thought, then leverage can potentially increase your loss a lot. In order to avoid a catastrophe, traders usually apply a certain trading style that includes stop losses etc.