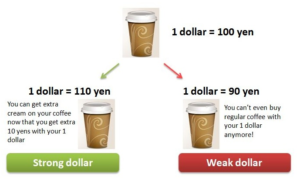

Definition of a weak dollar

Weak dollar is a situation where the value of USA dollar is decreasing against one or several foreign currencies. It basically means that for one weak dollar you get less foreign currency. Not only economical reasons but different factors may bring a periodical weak USA dollar. The term ‘weak dollar’ is used to describe a longer period, compared to a 24-48 hour decreasing of the dollar.

Weak dollar explication

Just like in economics, the strenght of a countries currency is cyclical and the periods of weaknesses and strenghts are inevitable. The reasons are different – economical, geopolitical events and influences from overseas countries.

On a period of fiscal restrictions when the USA Federal Reserve is increasing interest rates, it is likely that USA dollar will get stronger. Contrary to that, a weak dollar happens on a period of fiscal mitigations when the Central Bank of USA is decreasing interes rates.

Quantitative mitigation

As a response to a big economic downturn, the USA Central Bank started it’s famous quantitative mitigation. It means they started buying big amounts of exchequer and securities backed with mortgages. The treasury market was also increasing and that made interest rates decrease in a record. When interest rates dropped, USA dollar weakened significantly. In a period of two years (2009 – 2011) the index of USA dollar dropped 17% (USDX).

But four years later, when the Central Bank of USA started increasing interest rates for the first time after eight years, the situation of dollar was turned and it strenghtened for 10 years. In december of 2016 when interest rates were changed to 0.25 percent, USDX was traded in the hundreds for the first time since year 2003.

Tourism and commerce

Depending on the type of the transaction, possession of weak dollar is not always a bad situtation. For example a weak dollar may be bad news for a citizen of USA who want to have a vacation abroad, but it may be good news for those visiting USA. With a weak dollar USA may be a more inviting vacation spot for international tourists.

Most importantly, a weak dollar is good for the deficit of a countries commerce. If the dollar weakens, it’s export in the foreign markets gets more competitive since it gets cheaper for buyers overseas.

The debate over a weak dollar has become a political constant in the 21st century. There are several arguments in between USA and China regarding the strenghts of the countries. USA has threatened to mark the currency of China officially as a manipulator.